texas tax back dallas

Contact the Scammahorn Law Firm today to put an end to your tax problems. The minimum combined 2022 sales tax rate for Dallas Texas is.

How To Charge Your Customers The Correct Sales Tax Rates

The price of all motor fuel sold in Texas also includes Federal motor fuel excise taxes which are collected from the manufacturer by the IRS and are used to support the Federal Highway Administration.

. Compare 2022s Best Tax Relief Companies to Help With IRS Back Taxes. Youll earn a good amount of interest as much as 50 if he does. Box or Route number Phone Area code and number City State ZIP code.

The Tax Office locations below are closed to the public on the following days. This certificate does not require a number to be valid. 214 653-7811 Fax.

Wayfair Inc affect Texas. Located in Houston Texas The Galleria. If you make 55000 a year living in the region of Texas USA you will be taxed 9295.

214 653-7811 Fax. Records Building 500 Elm Street Suite 3300 Dallas TX 75202. This is the total of state county and city sales tax rates.

The homeowner retains the right to redeem or buy back his property for six months to two years if you bid successfully depending on the nature of the property. See reviews photos directions phone numbers and more for Back Tax locations in Dallas TX. Ad Forgot to File Your Taxes.

See reviews photos directions phone numbers and more for Claiming Tax Back locations in Dallas TX. Texas Tax Back store information. Federal excise tax rates on various motor fuel products are as follows.

Did South Dakota v. Texas tax liens are offered for sale by the counties once each month. This program is designed to help you access property tax information and pay your property taxes online.

The Dallas sales tax rate is. The Texas sales tax rate is currently. Payroll taxes in Texas are relatively simple because there are no state or local income taxes.

10 minimum sales tax per physical store. This marginal tax rate means that your immediate additional income will be taxed at this rate. 01-339 Back Rev7-107 Texas Sales and Use Tax Exemption Certification.

5085 Westheimer Rd Houston Texas - TX 77056 - 5673. Texas is a good place to be self-employed or own a business because the tax withholding wont as much of a headache. Records Public Branch Garland and South Dallas.

Also called a privilege tax this type of income tax is based on total business revenues exceeding 123 million in 2022 and 2023. Call Our Back Taxes Attorney In Dallas Tyler TX For Immediate Assistance. Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses.

Name of purchaser firm or agency Address Street number PO. The world-renowned surgeons at Texas Back Institute in the Dallas area have practiced minimally invasive cervical and lumbar spine surgery since the 1990s. Welcome to the Dallas County Tax Office.

The rate increases to 075 for other non-exempt businesses. These Tax Relief Companies Can Help. If driving to Texas or US bring I-94.

The County sales tax rate is. Since our founding in 1977 weve focused intently on developing surgical techniques that produce the best possible outcomes for our patients and their families. Looking for Tax Experts in Dallas TX.

What is the sales tax rate in Dallas Texas. We are proud to provide a selection of tax advisory services. Records Building 500 Elm Street Suite 3300 Dallas TX 75202.

A filed tax deferral aff idavit keeps homeowners from losing their homesteads because of delinquent property taxes. Tyler Dallas back taxes attorney Scott Scammahorn will work hard for you to resolve your back tax problem prevent or remove bank and wage levies and help you get the IRS out of your life once and for all. The law extends the tax deferral to the surviving spouse of the person who deferred taxes on the homestead if the surviving spouse was at least 55 years old when the deceased spouse died.

Check out Back Taxes Dallas. However multiple receipts from same physical store may be combined. Free Evaluation Apply Now.

That means that your net pay will be 45705 per year or 3809 per month. Your average tax rate is 169 and your marginal tax rate is 297. Hours contacts GPS coordinats ypu can find on this webpage.

How Long Can You Go Without Paying Property Taxes In Texas A Guide To How Long Property Taxes Can Go Unpaid In Texas Before For Foreclosure Tax Ease

When Tax Returns Are Not Filed If You Are Seeking Help Filing Current Tax Returns The Team Of Tax Professionals At Our Firm C Tax Return Tax Help Tax Attorney

Why Are Texas Property Taxes So High Home Tax Solutions

New Tax Law Take Home Pay Calculator For 75 000 Salary

Top Tax Preparation Services In Dallas Tax Services Income Tax Tax Preparation

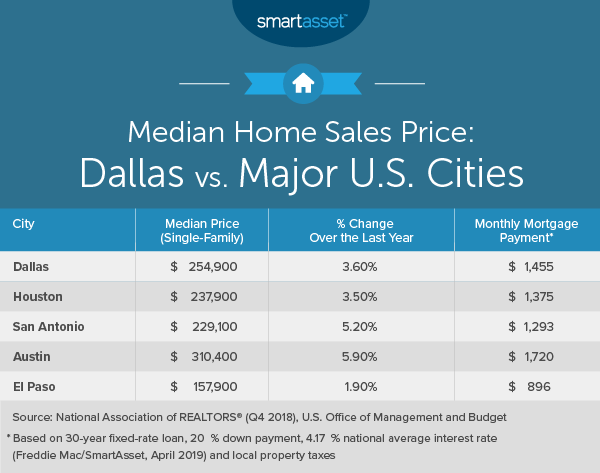

Cost Of Living In Dallas Smartasset

Tax Return Services Tax Refund Outing Quotes Good Credit

Schedule C Income Mortgagemark Com

Best Tax Attorney In Dallas Tax Attorney Tax Lawyer Tax Refund

Dallas Tax Attorneys Tax Attorney Tax Refund Tax

![]()

Dallas And Northeast Texas Chapter

Over 65 Property Tax Exemption In Texas

Collecting Past Due Child Support In Texas Frisco Family Lawyer Collin County

Texas Sales Tax Small Business Guide Truic